ValHYBRID: The Next Generation of Appraisals

Key Advantages of ValHYBRID

Consistent, Objective

Standardized data collection drives reliability and improves objectivity by limiting direct borrower-appraiser interaction.

Cost-Effective

Lower-cost alternative to traditional appraisals, reducing expenses for both lenders and borrowers.

Timely

Valuations completed in under 5 business days on average, advancing decision-making, underwriting, and loan closings.

Increased Appraiser Productivity

Qualified third-party inspectors handle data collection, maximizing appraiser focus on analysis and valuation.

Personalized, Nationwide Service

Benefit from the comprehensive reach of a national Appraisal Management Company (AMC) with personalized service on every order.

Eligible Transactions Per the GSEs*

Fannie Mae®

Forms: 1004 Hybrid and 1073 Hybrid

- Purchases, limited cash-out, or cash-out refinances

- Existing one-unit properties, including condos and PUDs

- Principal residences, second homes, and investment properties

- Properties under construction or with incomplete renovations

- Community land trusts and other resale price-restricted properties

- Texas 50(a)(6) loans

Desktop Underwriter® (DU®) will be updated on March 22, 2025 to reflect hybrid appraisal options.

Freddie Mac®

- Purchases, “no cash-out” and cash-out refinance transactions

- One-unit properties, including in a Planned Unit Development (PUD) or with an ADU

- Condominium Units (attached or detached)

Loan Product Advisor® (LPASM) will be updated on April 7, 2025 to reflect hybrid appraisal options.

* The lender will receive eligibility codes from the GSEs to know if they can order this product. Eligibility subject to GSE updates; refer to: Fannie Mae’s Selling Guide, B4-1.2-03, Hybrid Appraisals and Freddie Mac’s Guide, Sections 5602.4, 5604.1 and 5604.2.

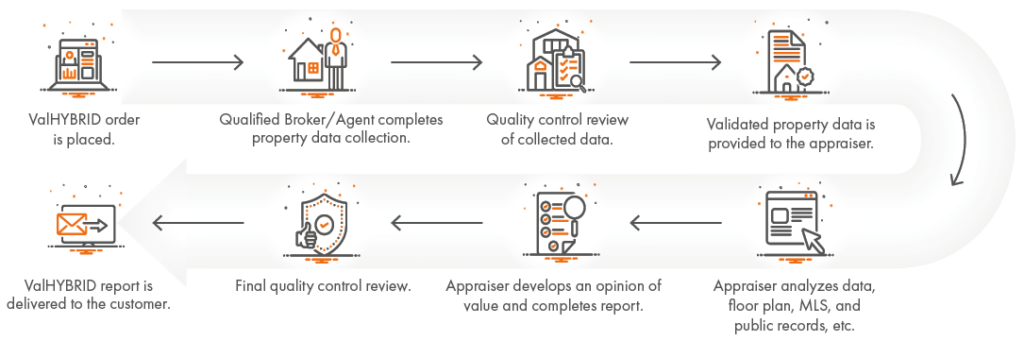

How ValHYBRID Works

ValHYBRID uses a bifurcated approach to maximize valuation efficiency. Trained and vetted third-party professionals collect comprehensive property data (including ANSI floor plans) following the Uniform Property Dataset. A state-certified appraiser with local expertise then analyzes the data to develop a credible opinion of value— empowering informed loan decisions while ensuring compliance.

Interested in Learning More?

Speak With Our Team

877-490-0390